When I was digging deep into my septuagenarian memory banks last month in a desperate effort to come up with an anecdote that could in some way stir the emotions of a generation of investors brand new to the world of junior resource investing, I came up with the story of "Jammie, " the little Irishman that taught an entire blue-blood brokerage firm how to navigate an inflationary spiral in the 1970s. As difficult as that was, it is easy to recount an old yarn that you have spun to hundreds of listeners and readers over the years, not unlike riding the proverbial bike. What is not easy is trying to find in one's experiences some form or shape of symmetry with the environment we all face today.

Due in no small part to the advent of the internet and, more recently, the dominance of social media, younger investors need not do any serious reading — as in "due diligence" — to be able to answer any and all questions about the security they own (or are seeking to own) because all that the is required is an internet signal and they can source any opinion offered along with twenty different investment rationales for owning it.

In my early years, I was given a card offered by the "Financial Post of Canada" that gave you literally all of the pertinent information — all financial, I should add — about any company listed on Canadian exchanges. The U.S. version for we young 1970s whippersnappers was "The Value Line Investment Survey," which provided young finance grads like me that unique ability to grind out all of the ratios and compare them to other companies in similar industries to provide a ranking system as a prerequisite for investment.

To say that it was an agonizing task for a man accused of being "hyperactive" as a child (long before the world decided to stigmatize that term as a disease called "ADHD") is an understatement. I transferred away from accounting in university for that very reason, but not before I had a minor in "Bean Counting 101," so during those rare moments where I had to look up G&A expenses for a junior mining company, I at least knew where to find them.

Today's markets are easily the most perplexing that I have ever encountered, in the sense that there is nothing left of the "free market" where the two primal human emotions of fear and greed can manifest themselves in uninhibited price action. Since the day that "carbon units" were banished from the trading pits of the world stock exchanges and replaced with highly-skilled robots that could transmit 50 orders simultaneously to what it would take a human to transmit one, the ability to "read the tape" went the way of the buggy whip in the 1800s or the blackboard eraser in 1990.

Mind you, the advances in technology are not the villains here; they are merely the messengers of change that have always been seen as a threat to those that have found great comfort and sustenance in the "old ways" as in the manner in which Jamie Dimon dismisses Bitcoin as being "shit." To those readers who are owners of Bitcoin, you should take solace in the fact that Dimon's firm, JP Morgan-Chase, is the most heavily fined of all the Wall Street banks with more of their ex-employees banned from the securities industries than any other securities firm around the world.

In fact, the movie The Wolf of Wall Street should have been framed around Jamie Dimon rather than Jordan Belfort because all Jordan did was pump penny stocks, costing little investors millions, while Dimon's firm manipulated LIBOR and, of course, the precious metals costing investors BILLIONS while Jamie is held in "awe" as a featured guest in Davos on CNBC!

People the world over look at Jamie Dimon with the utmost reverence. I do not. He runs a banking outfit (J.P. Morgan Chase) that has paid more fines to the SEC and DoJ than any of the other money center banks. His futures trading division has been nailed time after time for violation after violation for "spoofing" and "manipulating" prices, but not once has Dimon ever been held under scrutiny. Yet, Andrew Ross Sorkin, who toils for CNBC and who made millions from his mediocre book "Too Big To Fail," after which he made millions from the movie deal, honors Dimon this week with a front-and-centre interview during prime-time Davis with all the world watching.

Sacrilege!

Stocks

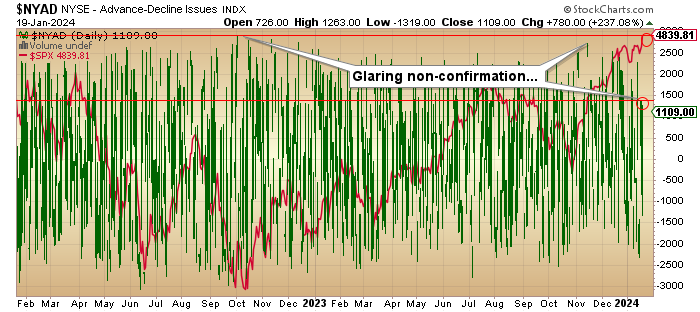

The boys on Wall Street finally got their wish as the S&P finally surpassed the old highs from January 4, 2022, and powered ahead to a closing record of 4,839.81, fueled largely by the record short positions held by option arbitrageurs and prop desk chicanery.

While my bearish stance is now officially at the test, the NASDAQ has yet to register a new all-time high and the DJ Transports are still a long way from their all-time high of 16,860 which still constitutes a Dow Theory non-confirmation despite the new high in the S&P. Also lagging desperately is the NYSE advance-decline line which did not lead stocks to a new high today and represents a pretty solid negative divergence.

The mid-month reading for the averages registered lower levels than when the month began, which bodes poorly for the January Barometer, but in the final analysis, it will be the final performance of the market averages for January that will determine its predictive outcome. I have been carrying a modest short position until today, at which point, by the close, it was doubled.

The reason I added it was a piece of guidance taught to me decades ago by the legendary Newton Zinder, a technical analyst for the venerable Wall Street investment house E.F. Hutton, a firm I absolutely loved back in the 1980s when my firm had an associate relationship with them through their futures division. Newton told me that after particularly violent option expiry Fridays, the following Mondays tend to reverse the previous session's action. Today was just one of those "violent OP-EX Fridays," so I stepped up.

Will my bearish posture be proven correct?

I am not exactly 100% convinced that the powers that control stock prices wish to see a sagging stock market going into what is going to be a nasty U.S. election season. As always, I will let the language of the stock market's internal indicators guide me and if January goes out with at resounding new highs, I will happily join the party.

Gold

I purposely left silver out of today's discussion because it acts absolutely like what my late and former RCAF navigator father used to call "road apples," referring, of course, to the droppings of milk wagon horses in downtown Toronto that they used to use as road hockey goalposts back in the 1920s. Silver is acting so badly that it is useless to even post a chart.

Also falling into the category of "Hilarious Antics" is that two of the darlings of the market since summer have been two junior explorers that both go by the mantles of Hercules Silver (BADEF:OTCMKTS;BIG:TSXV) and American Eagle Gold Corp. (AE:TSXV) but where their share prices have been vaulted northward by discoveries of copper. Also, making the shift away from silver is one of my absolute favorites — Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB) — whose management team are rapidly pivoting to copper with the acquisition of the Caballos Copper project in Chile.

Needless to say, gold is acting just fine but silver is not. Gold looks like it might pull back to the $1,965-1,970 level before gathering more steam, but silver has the teens written all over it.

To all of you silver bugs out there, and I say this with the utmost sincerity, I feel for you all. It took me the better part of 45 years of head-slamming into brick walls before I finally decided to stick with the metal being hoarded by central banks rather than the metal being hoarded by bunker-bound doomers looking for their "stack" to lift them to the top of the mountain.

Gold is where I want to be, but after copper, it is the preferred metal for 2024.

Electrification

The three main metals that constitute the "Electrification Trilogy" are uranium, lithium, and copper.

Of those three metals, one is on fire, one is in freefall, and one is ready to explode. However, of those three metals, only one has a demand-supply set-up that is independent of the electrification movement, and that one is uranium. However, it has already advanced from under $20/lb.

In 2019, it will be over $110/lb. Here in 2024. I have been a uranium bull since 2017 and have been forced to be a very patient bull during that long and drawn-out wait for the fundamentals to finally kick in. Now that we are seeing the result of supply issues with not only Cameco Corp. (CCO:TSX; CCJ:NYSE) but also the mighty Kazatomprom (KAP: LSE), the world's premier producer of uranium, it looks as though prices could challenge the 2009 highs of $138/lb.

The problem I have, however, is that the miners are acting poorly. They act as though someone knows something. Management departures at Kazatomprom and missed guidance at Cameco are sending out more than a few vibes that all is not completely well in the uranium space.

The Twitterverse narrative is solidly bullish. There is not one tweet from not one fuzzy-cheeked, IPhone-tapping newbie that is anything short of "To the moon!" after which they recite 50 reasons why they are NOW — as opposed to four years ago at $20/lb. — wildly bullish — on the space at over $100/lb. It was only eight months ago that I was as excited as could be with the prospect that lithium demand was about to move to an out-of-control impact regime due to EV sales in the U.S. and abroad (especially China).

I feared that I was late to the party based on the price action for "all things lithium," so I chose the "briners" over the "miners" on the assumption that Direct Lithium Extraction from oilfield brines allowed far more rapid entry into positive cash flow status than several billion tonnes of Spodumene-Pegmatite-bearing rock in northern Quebec.

I elected to place my wager upon Volt Lithium Corp. (VLT:TSV;VLTLF:US) in the $0.20 range because it carried a relatively low market cap under $30 million versus its "briner" competitor, E3 Lithium Ltd. (ETL:TSXV;EEMMF:US) capped at over $200 million at the time.

Alas, the entire group has been sent into a downward plunge that is going to be tough to reverse. I moved Volt from Aggressive Buy to Hold in November after they missed milestones in August and September on the assumption that the highly impressive management group could overcome the oppressive headwind of the crashing lithium price and battery metals glut.

Even the Australian market commentators are now referring to the existence of a "battery metals glut," and if it gets to the point of the #1 country in the battery metals world acknowledging a "glut" in lithium, I am forced to take action.

Now, Volt has a superb management team so my heart lies in their ability to shrug off this (hopefully) temporary lag in lithium demand and strike a number of U.S. DLE deals that can supersede the bearish narrative and vault them to the top of the pack. At a CA$23 million valuation, Volt is valued substantially below its peers and remains solidly good speculation at these levels. However, it is facing a massive headwind in the form of horrid investor sentiment and that should not be discounted in any way, shape, or form.

Admissions From the Heart

As a newsletter writer focused on the companies that used to be the number one focus for youthful speculators in the pre-2000s, I am rapidly falling into extreme disaffection with this entire space. I have a great many friends who are younger than my children and have made more money in the technology and cannabis space in their short lives than I (or any of my friends) have made in five decades.

The reality remains that junior mining, once the lifeblood of the seasoned speculator, is now a moribund sector devoid of excitement and bereft of the characters that made it such a great place to invest. Readers of this missive are familiar with the aging personalities of the last truly great bull market in exploration juniors. The Godfather of the Junior Mining Newsletters — Robert "Bob" Bishop — is now fully-retired and enjoying life while personalities like Pierre Lassonde and Eric Sprott are now viewed by the kids as "dinosauric" in temporal significance and "irrelevant" in profit-generating relevance.

That is because none of these Millennial "analysts" would know how many elements are contained in that iPhone they are staring at as they enter a crosswalk at Bloor and Yonge. When they all collectively agree by way of three million simultaneous "LIKES" (thumbs up on Facebook or Instagram) that a 2mm ounce deposit in Nevada owned by a fifteen-cent junior like Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) is worthy of their Millennial and Genex-ial dollars, the stock will move from "ridiculously underpriced" to "fair value" and that would be a quintuple.

When gold moves above $2,150 to $2,500 and beyond in 2024 (and it will), the most-hated group of juniors that own sizeable resources will simply and purely explode higher. If anyone reading this missive can provide me with a timeline on that, it would be appreciated.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Gold, Silver, Uranium, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Norseman Silver Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, [Volt Lithium Corp.] has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Cameco Corp., Getchell Gold Corp., Volt Lithium Corp. Norseman Silver, and American Eagle Gold Corp.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [Norseman Silver Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.